Features of KPK-PF

- Competitive Returns

- Low Management Fee

- Professional fund management expertise

- Ease of redemption

Risk Meter

Fund Facts

Fund Type

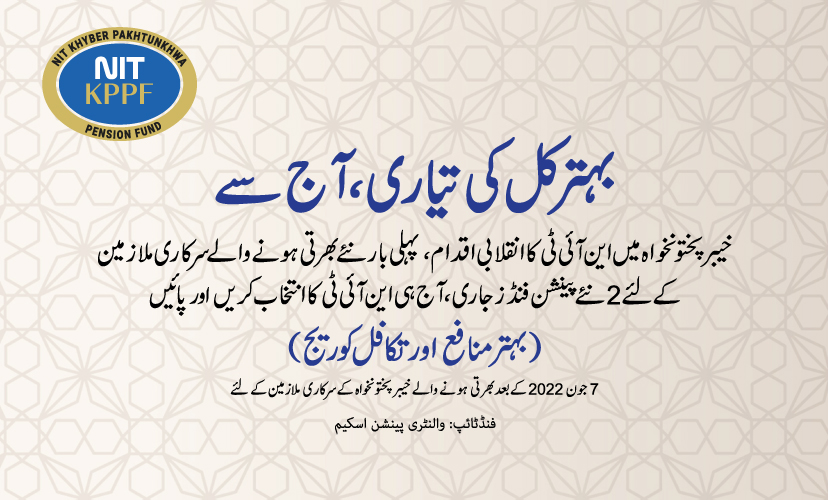

NIT Khyber Pakhtunkhwa Pension Fund (NIT-KPPF)

Fund Structure

Unit Trust Scheme consisting of Sub-Funds under

the VPS Rules 2005.

NIT KP Pension Fund - Equity Sub Fund

NIT KP Pension Fund - Debt Sub Fund

NIT KP Pension Fund - Money Market Sub Fund

NIT KP Pension Fund - Equity Index Sub Fund

Eligibility

All Employees of KPK Government appointed/recruited

under the Khyber Pakhtunkhwa Civil Servants (Amendment)

Act, 2022 or an employee of the KPK Government,

regularized as civil servant through any legal instrument,

issued after coming into force of the Khyber Pakhtunkhwa

Civil Servants (Amendment) Act, 2022 irrespective of the

effective date of regularization shall be eligible to contribute

to the Pension Fund.

Minimum Contribution

The minimum amount of Contribution to open an account is

Rs. 1,000/- and the minimum amount of contribution to an

existing account is Rs. 1,000/- per transaction or such other

amount as may be prescribed by the Employer.

Change of Allocation Scheme

The Employee may change the Allocation Scheme as and

when required till retirement. Form for the change in

Allocation Scheme must be sent by the Employee in writing

or in such other form as may be acceptable to the Pension

Fund Manager.

Front-end Fee

No Front End Load shall be deducted from the Contributions

received from the Employee(s).

Taxation

Tax Credit will be available to Employee(s) on contributions

during any Tax Year subject to the limits prescribed under

Income Tax Ordinance 2001.

The Pension Fund Manager shell offer Allocation Scheme to the Employees according to their risk/return and age requirements, through Sub-Funds of the NIT KP Pension Fund, managed by the Pension Fund Manager. The risk profile of each Allocation Scheme shall be dependent on the percentage allocation of that Scheme in the various Sub Fund. Each Allocation Scheme being offered can have exposure to the following sub-Funds:

(a) NIT KP Pension Fund - Equity Sub Fund;

(b) NIT KP Pension Fund - Debt Sub Fund;

(c) NIT KP Pension Fund - Money Market Sub Fund;

(d) NIT KP Pension Fund - Equity Index Sub Fund;

The Contributions recieved from an Employee shall be allocated amongst the Sub-Funds in accordance with the Allocation Scheme selected by the employee or default allocation scheme as laid in the Second and Third Schedule respectively (in terms of proviso of rule 5(d) (ii)) of the Employee KPK Rules. The Employee has the option to select any one from the Allocation Schemes or products being offered by the Pension Fund Manager at the date of Opening of Individual Pension Account. The Pension Fund Manger is offering the following Allocation Scheme to allocate the Contribution recieved from the Employees in the Sub-Funds:

(a) Life Cycle Allocation Scheme:

This Allocation Scheme provides the Employees with an option to allocate their contributions in a pre-planned allocation strategy as per their age. The Younger the Employee, the higher the allocation towards equity market due to his/her risk-taking ability with reference to long term horizon.

| Age | EQUITY INDEX SUB-FUND | EQUITY SUB FUND | COMBINED EXPOSURE TO EQUITY | DEBT/MONEY MARKET SUB-FUND |

| For the period of 3 years from date of account opening | 0% | 0% | 0% | 100% (only in Money Market - Sub Fund) |

| Up to 30 years | Max 50% | Max 25% | Max 50% | Min 50% |

| Up to 40 years | Max 40% | Max 20% | Max 40% | Max 60% |

| Up to 50 years | Max 30% | Max 15% | Max 30% | Min 70% |

| Up to 60 years | Max 20% | Max 10% | Max 20% | Min 80% |

The exact exposure to each Sub Fund within the Allocation Scheme would be decided by the Employee at time of account opening and may be changed at any time at the discretion of Employee subject to age limits prescribed under KPK Rules.

(b) default Asset Allocation Scheme:

If no choice is made by the Employee, then Default Asset Allocation Scheme, Pension Fund Manager keeping in view the profile and age of the Employee, shall allocate the Contributions to the default Asset Allocation Scheme as follows:

| Age | EQUITY INDEX SUB-FUND | EQUITY SUB FUND | COMBINED EXPOSURE TO EQUITY | DEBT/MONEY MARKET SUB-FUND |

| For the period of 3 years from date of account opening | 0% | 0% | 0% | 100% (only in Money Market - Sub Fund) |

| Up to 30 years | 30% | 10% | 30% | 30% |

| Up to 40 years | 20% | 10% | 30% | 40% |

| Up to 50 years | 15% | 5% | 20% | 60% |

| Up to 60 years | 10% | 0% | 10% | 80% |

| Sub-Fund | Maximum Total Expense Ratio excluding insurance charges and Govt levies (as % of Net Assets) | Maximum insurance Charges (as % of Net Assets) |

| Money Market Sub-Fund | 0.75% p.a. | 0.25% p.a. |

| Debt Sub-Fund | 0.75% p.a. | 0.25% p.a. |

| Equity Index Sub-Fund | 1.00% p.a. | 0.25% p.a. |

| Equity Sub-Fund | 1.75% p.a. | 0.25% p.a. |

WANT TO SIGN-UP

FOR CP FUND ?

FOR CP FUND ?

Watch video to get step by step guidance to register CP Fund

Simply click on the button below to register for your CP account. In the AMC section,

choose National Investment Trust Limited as your preferred AMC.

Offering Documents

Please Choose

Fund FMR

Please Choose

Consolidated FMR

Please Choose

Trust Deed

Please Choose